ICO vs. IEO vs. IDO: Breaking Down the Major Differences

The blockchain and cryptocurrency industry hopes to address the dependence on centralized platforms and financial structures. For example, to raise money, a firm might conduct an initial public offering (IPO), but in the decentralized world of cryptocurrencies, how can businesses raise money for the introduction of new tokens?

The bitcoin market is very creative when it comes to raising money for new endeavours. There are only two ways to raise money in the traditional financial sector: loans or venture capital (VCs). Over time, though, the creators of the new project end up losing out due to this strategy.

The cryptocurrency industry is diverse, and owing to the various funding options available to them, new initiatives can make money while connecting with the community. For example, cryptocurrency and blockchain startups can exchange their tokens for fiat currency or other cryptocurrencies. The funds are then used to grow the initiative.

Highlights

- 1 ICO vs. IEO vs. IDO: Breaking Down the Major Differences

The three most popular ways for cryptocurrencies to generate capital are initial coin offerings (ICOs), initial exchange offerings (IEOs), and initial DEX offerings (IDOs). Below, we go over each of these strategies in detail, along with the benefits and drawbacks. We will also outline major differences between ICO vs. IEO vs. IDO capital calls that will help you better understand the crypto market.

Explaining Initial Coin Offerings (ICOs)

Source: WallStreetMojo

Initial Coin Offerings, or ICOs for short, used to be the industry standard for raising money. A startup company seeking investment needs merely to deliver a white paper outlining the planned system’s operation. Then, there would be a token sale, with the coins acting as potential working units of money.

Despite being introduced in 2013, ICOs didn’t gain popularity until 2017. Industry reports claim that ICOs raised an astounding $5.6 billion. However, a fast Google search would show that this strategy peaked about the same time Bitcoin achieved an all-time high in history.

Although it took ICOs some time to become well-known, the general public quickly lost interest in this strategy. And reports showed that only 84 projects raised about $350 million, a significant decrease from the prior financing levels.

Pros

- ICOs quickly raise money because they are simple to understand and have a low fundraising threshold.

- Business owners can attract investors from all over the world using ICOs.

- Practically all ICO development services campaigns last for thirty days, and almost all businesses acquire funding within this time.

Cons

- The success rate of ICO projects is often low.

- If the ICO project fails, the tokens will lose value over time and finally become worthless.

- The availability of regulatory tools for ICOs is limited.

- Fraud can be committed in a variety of ways.

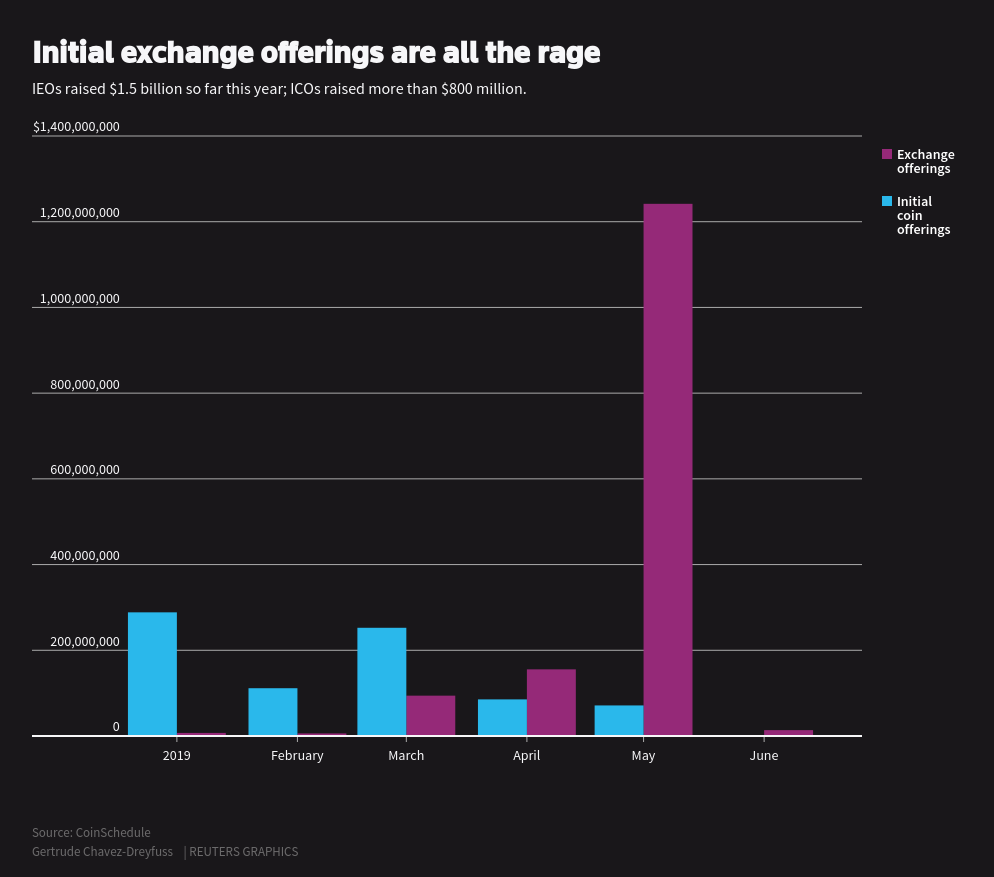

Initial Exchange Offering (IEO)

Source: Reuters

Similar to an ICO, an IEO (Initial Exchange Offer) claims that the token will undoubtedly be listed on the market and that investors wouldn’t be taken advantage of.

Additionally, crypto efforts in IEOs have undergone intense scrutiny, and the barriers to initiatives participating in an IEO were comparatively high. As a result, there is trust among dealers and the larger crypto community. Some of today’s trendiest blockchain projects, like Polygon and Elrond, got their start as IEOs.

Pros

- Investors are guaranteed very high security because all exchanges undergo KYC/AML verification.

- In contrast to ICOs and STOs, investors participate directly in the exchange.

- Because of the regulatory framework, the platform is dependable and safeguards investors from dishonest practices.

- Participants transfer money directly to their accounts rather than through a smart contract.

Cons

- In IEO, the cost of fundraising is quite expensive, and the system itself is challenging to set up.

- Compared to the other two, liquidity is very low.

- nvestors have virtually little influence over the exchange’s operations.

Initial DEX Offering (IDO)

Source: Bitcoin.com News

Projects can use an IDO to make their recently created crypto tokens available to the general

public by employing a DEX. Before a project issues its native coin, investors can lock money inside a smart contract using a conventional IDO. Then, at the time of token generation, or when a project issues its token, investors receive the new tokens in exchange for the cash that is being transferred to the project.

IDOs provide projects with a rapid and inexpensive option to distribute their tokens and raise money while offering investors a higher level of security than ICOs. Additionally, the majority of IDOs demand that participants register beforehand by adding their names to the whitelist via a website or social media platform.

Pros

- No one’s consent is required.

- Quick liquidity

- Always able to conduct business

- Easy and equitable crowdsourcing for all

Cons

- Insufficient control mechanisms

- Instantaneous pricing changes when doing huge-volume trades

- There is no reliable information on investors.

ICO vs. IEO vs. IDO: What Are the Main Diffrences?

Project owners can raise a lot of money for project development through these 3 types of capital calls. But, at the same time, investors can purchase products at fair discounts.

The location of the sale is where these three strategies of capital raising diverge most noticeably. For example, IEO and IDO are both open for purchase on centralized exchanges, but ICO and IEO are only available for purchase directly on the project’s website.

| Difference | ICO | IEO | IDO |

| Meaning | A portion of total token sold to the public | Token sold to the public through CEX | Launch on decentralized launch platform |

| Marketing | Must spend the optimum amount of money promoting it | Promotes and markets the IEOs | Both the launch pad and the project market themselves |

| Who does fundraising? | The project that is launching ICO | The centralized exchange | A decentralized exchange or launch pad |

| Token Listing | The project seeks listing of tokens on various exchanges | The CEX automatically enumerates the token | Same as IEO |

| Token Availability | Investors must wait for them to be listed on an exchange | Tokens will not be available for trading immediately | Tokens are available immediately or having vesting period |

| Selection process | Anyone can launch an ICO | Need to follow a rigorous process | Must meet launch pad standards |

| Smart contract | Manage by the project that is issuing the ICO | Crypto exchange is in charge of this | IDO manage it collectively |

As their names would imply, IEO, ICO, and IDO differ in the middle letters, Exchange, Coin, and Decentralized. IEO relies on centralized exchanges that are governed by governments, which is one of the greatest disparities.

Therefore, cryptocurrency ventures may select IEO for regulatory purposes. IEO may no longer be a barrier to a crypto project going public in the future, whilst projects using ICO and IDO procedures are not subject to SEC scrutiny.

The SEC is currently focused on pursuing charges against ICO issuers and projects that launched ICO. The SEC’s escalating regulatory activity is forcing cryptocurrency inventors to switch to safer techniques like IEO and IDO.

Last Words on New Ways of Fundraising in the Digital Era and Understand The IDO vs IEO vs ICO

Today, a variety of solutions are available to assist businesses in raising money using blockchain and decentralized finance. These innovative methods of fundraising assist close the funding gap between small and large businesses, allowing you to raise more money to grow your company.

Additionally, investing online gives investors a chance to invest in emerging trends for the future. However, investing in digital assets still carries a significant level of risk, so do your due diligence.

If you want to sail into the blockchain market, hire skilled blockchain developers and arrange a one-to-one discussion to raise global capital.