Crypto Trading Strategies That Every Crypto Trader Needs to Know

If you want to succeed in the risky world of cryptocurrencies, you’ll need steely nerves, a solid strategy, and an easy-to-use trading platform. Through investigation, you’ll discover the steely nerves and the user-friendly trading platform. Let’s look at the X-factor in this soup, which is the type of crypto trading strategies you engage in.

Some of the most well-liked day trading tactics are range trading, scalping, and arbitrage. There are many trading strategies and platforms available.

You might have heard about cryptocurrencies. Over the past ten years, cryptocurrencies have evolved from a mysterious technical proof of concept to a multi-billion-dollar asset class. Short-term traders’ interest has been piqued by rising prices and interest, while investors’ attention has been drawn by the long-term potential to disrupt various markets and the potential advantages of diversification.

Let’s examine the five different crypto trading strategies and how to know where you fit in this saturated market.

What is Trading in Crypto?

Trading cryptocurrencies entails purchasing and reselling them in order to make money. Cryptocurrencies have their own digital currency exchange where people may trade coins, similar to how traditional currencies have a foreign exchange (forex).

- Trading in cryptocurrencies is a 24-hour market, in contrast to the conventional stock exchange, which closes at the end of the day.

- People must select a cryptocurrency wallet and an exchange before they can begin trading.

There are around 1,500 cryptocurrencies in existence, but to limit losses in the incredibly volatile cryptocurrency market, newcomers are advised to start trading in well-known coins like Bitcoin or Ethereum. Additionally, there are several wallets available from which you may quickly purchase bitcoin and begin your cryptocurrency journey.

In simple terms, trading stands for buying and selling digital currency using a trusted platform. Now before digging into strategies, here we are going to explain to you how crypto trading works.

How Does Cryptocurrency Trading Work?

There are two simple methods for buying bitcoins. The first is comparable to trading in stocks in that it involves using a digital wallet to purchase cryptocurrencies at the going rate. Once you have the currency, you can make money by selling it for more than you originally paid.

As an alternative, you can trade CFDs on cryptocurrencies. This is similar to trading FX and commodities, in which you trade on price changes rather than owning the ‘real’ item and can make money whether the price is rising or falling.

Leverage is a feature of bitcoin CFD trading that enables you to access bigger value trades with a little quantity of cash.

Various Crypto Trading Strategies You Need to Know

The five most common cryptocurrency trading strategies are arbitrage, buy and hold, swing trading, day trading, and scalping. And even while we explain what these crypto trading methods are and how they operate, we don’t give you any recommendations on how to put them to use. So always do your own research before purchasing or trading cryptocurrency.

The Day Trader

Source: Bybit Learn

One of the most popular methods of trading on the crypto market is day trading, often known as intraday trading. Although intraday trading is when professional traders get the majority of their gains, it is also the riskiest.

On the same day, day traders buy and sell digital currencies or ETFs (Exchange-Traded Funds). Day trading entails closing positions on the same day, so there are no Demat transaction fees to pay.

To place precise transactions, day traders examine the momentum of stocks, indices, or ETFs. Either they buy initially and sell afterward, or they first sell and then buy. However, it is advised against trading on margin if you are a beginner trader. If the trade turns out badly for you, margin trading could multiply your losses.

The Swing Trader

Source: Steemit

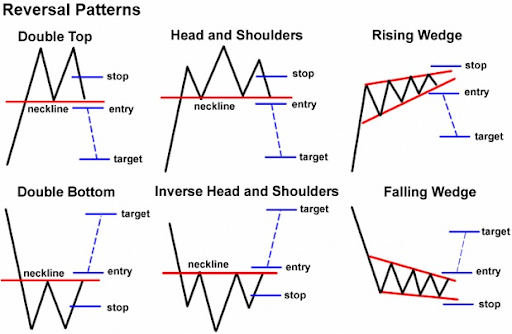

The normal trading period for swing traders is a few days or a week. They rarely utilize a lot of leverage, unlike day traders, and almost always position overnight. To maximize their profit from a price movement, most swing traders employ technical analysis tools to forecast trend reversals or the swing in price from low to high or high to low.

For instance, a swing trader might spot a Bitcoin chart pattern that signals a downtrend’s reversal. The swing trader may take a long position after the price breaks the neckline and hold it until there is evidence of a lower reversion.

If so, they might even close the position and trade short to profit from the downward trend.

The Position Trader

Due to their extended time horizons, position traders are frequently mistaken for investors. Position traders typically trade over the course of weeks or even months. Position traders, as opposed to swing traders, prefer to spot a trend and enter a trade along with it rather than trying to catch the proverbial falling knife by forecasting a reversal.

- For instance, a position trader may observe that the price channel and the Relative Strength Index (RSI) reading for Bitcoin has been rising, indicating a bullish trend.

- When the RSI reading begins to decline or the price breaks through lower trend line resistance along its price channel, it may take a long position and keep it there until the RSI reading rises again.

The Diversified Investor

Long-term asset holding is a common practice among investors. Unlike swing or position traders, their objective is often portfolio diversification rather than a simple bet on price appreciation.

Exchange-traded funds (ETFs), which trade on a stock exchange but hold a sizable amount of cryptocurrency assets, are most likely how investors will obtain future exposure to the crypto market.

For instance, an investor might buy crypto assets to spread out the risks associated with equity. Cryptocurrencies can be employed in a portfolio to balance the risk of a substantial decrease in equity prices because they typically have a poor or negative correlation with equities. Cryptocurrency assets themselves may also have substantial upside potential.

The Bottom Line

When it comes to cryptocurrencies, there is a definite difference in the world. Supporters of the idea that cryptocurrencies are superior to conventional currencies, including Bill Gates, Al Gore, and Richard Branson, are on one side of the debate. People opposed to it include Warren Buffet, Paul Krugman, and Robert Shiller. The Nobel laureates in economics Krugman and Shiller see it as a Ponzi scam and a front for criminal activity.

There will be a clash between regulation and anonymity in the future. Governments would want to control how cryptocurrencies operate because a number of them have been associated with terrorist activities. The major goal of cryptocurrencies, on the other hand, is to guarantee user anonymity.

By 2030, according to futurists, cryptocurrencies will account for 25% of all national currencies, which means that a sizable portion of the global population will begin to trust cryptocurrencies as a means of payment. It will continue to have a volatile nature, which means prices will fluctuate as they have for the past few years, and it will be more and more accepted by businesses and customers.

If you are a beginner in the crypto market but want to enter this lucrative field, Elluminati Inc. is here to help you. We have a team for crypto exchange software development, and we will surely help you to disrupt the market with the finest solutions.