What is cryptocurrency? Types, Cost and Process to Launch It

The news about cryptocurrencies is reported every other day. However, due to its rising popularity, it is simpler to turn your eyes in its direction. Cryptocurrencies are becoming a component of investing as a result of their increasing demand and widespread acceptance. Despite the allure and excitement of investing in cryptocurrencies, it is important to understand what a cryptocurrency is and how it operates.

The world has been swept up in the cryptocurrency boom, just like other manic riches rushes in the past. As a result, most business owners are keen to participate in the growing number of use-case scenarios for cryptocurrencies and blockchain technology.

Highlights

- 1 What is cryptocurrency? Types, Cost and Process to Launch It

ICOs have increased as a result of the bitcoin industry’s explosive expansion. Over 2.2 billion dollars were raised through ICOs in just 2017 alone (up from USD 62.6 million in 2016). First, it’s crucial to master certain fundamentals that will enable you to sail your boat before you hastily launch your own coin.

Digital currency, known as cryptocurrency, is decentralized, based on blockchain technology, and encrypted. Therefore, blockchain, decentralization, and cryptography are the first three concepts one must comprehend to understand cryptocurrencies. As the word blockchain has become a buzzword in the investment industry, more and more people have begun to wonder how to create a cryptocurrency, how much it costs, and how to launch it in the market.

Hold on; this article will guide you along through the main overview, types, launching, costing, and other critical aspects of new crypto creation. At the end of the blog, you will also come to know how coins and tokens differ and what is the future of crypto as well as:

- Overview of Crypto in simple words

- Various types of cryptocurrencies

- Ways to launch your own cryptocurrencies

- Costing to create your own cryptocurrencies

- And the future of crypto

So without any ado, let’s get started and elaborate on each point.

A Brief Overview of Cryptocurrency

A digital asset known as cryptocurrency (or “crypto”) can be traded without the aid of a central monetary institution like a bank or government. Instead, cryptographic methods are used to produce cryptocurrencies, making it possible for users to buy, sell, and exchange them safely.

With Bitcoin widely regarded as the first successful cryptocurrency of this type, the world of cryptocurrencies made its huge debut. It was advertised as a peer-to-peer electronic cash system that would completely eliminate any middlemen and decentralize. As additional cryptocurrencies entered the market alongside Bitcoin, the number of options available to potential investors increased yearly.

Now, you all know crypto is nothing but a digital currency that tracks and stores data through a blockchain system. The number of network rights that a blockchain can grant is theoretically limitless, but they often fall into one of four categories:

- Equity Tokens

- Utility Tokens

- Intrinsic Tokens

- Asset-backed Tokens

Some Important Stats To Consider

- Given the significant fluctuations in cryptocurrency prices and their sharp ascent in recent years, this statistic may soon prove to be erroneous. The combined market value of all cryptocurrencies as of late mid-August 2022 is $1,172 billion, which is enough to rank as the 20th largest country in the world by gross domestic product.

- The most widely used cryptocurrency, according to exchanges, is still bitcoin. The current Bitcoin market share is 39.3%.

- You’d have to acknowledge the asset’s ascent to prominence when examining the size of the cryptocurrency market as a whole. Cryptocurrencies, which are constantly in the news, trade large amounts daily as their market capitalizations increase.

The top ten cryptocurrencies include many other emerging coins, in addition to Bitcoin, Ethereum, and Litecoin. On the basis of market capitalization, the following are the most popular cryptocurrencies,

- Bitcoin

- Ethereum

- Stablecoin

- SD Coin

- Binance

- Ripple

- Binance USD

- Solana

- Polkadot

- Cardano

79% of daily average transaction volume is accounted for by the top 10 bitcoin exchanges worldwide. The daily trade volume on the exchanges Venus, HitBTC, Bitcoin.com, Changelly, Binance, Upbit, Huobi Global, HBTC, OKEx, and VCC Exchange is $250.8 billion.

These are the most important statistics to consider when you want to go deeper into cryptocurrencies. Now you have enough knowledge about this popular digital currency. So, let’s have a look at its different types.

What Are the Different Types of Cryptocurrencies

Thousands of cryptocurrencies exist today, and a large number are being launched every day. However, there are subtle and not-so-subtle distinctions between them, even though they all rely on the same fundamental idea of a consensus-based, decentralized, and irreversible ledger in order to transfer value digitally between trustless parties. Taking care of all such points becomes much easier by hiring a cryptocurrency developer who is proficient with a diverse range of experience.

Here we are to clarify the market and attempt to classify cryptocurrencies into four major categories:

- Payment Crypto

- Utility Tokens

- Stablecoins

- Central Bank Digital Currencies

Now you must be thinking, what do tokens mean here? Don’t worry; we will later explain to you the difference between coins and tokens but first, let’s understand these four types.

Payment Cryptocurrencies

Payment cryptocurrency is the first significant class of crypto. The first successful crypto used for digital payments was Bitcoin, which is possibly the most well-known crypto. A payment crypto serves as a means of payment as well as peer-to-peer electronic cash to facilitate transactions, as the name suggests.

Examples include Bitcoin, Litecoin, Monero, and Bitcoin Cash.

Utility Tokens

Utility tokens are the second most prevalent type of cryptocurrency. Any digital asset that runs on top of another blockchain is a token. The Ethereum network initially introduced the idea of allowing other crypto assets to leverage its blockchain.

In reality, Vitalik Buterin, the creator of Ethereum, envisioned his digital asset as an open-sourced programmable currency that would enable decentralized apps and smart contracts to bypass established financial and legal institutions. These tokens are sometimes referred to as infrastructure tokens, and you may hear these sorts of words,

- Service tokens

- Finance tokens

- Governance tokens

- Media and entertainment tokens

- Non-fungible tokens (NFTs)

Stable Coins

Stablecoins are intended to act as a store of value due to the volatility that is present in many digital assets. Despite being based on a blockchain, they retain their value since they can be converted into one or more fiat currencies. Stablecoins are truly anchored to a real currency, most frequently the US dollar or the Euro.

To ensure the value of the crypto, the business that oversees the peg is obliged to have reserves. As a result, investors may utilize stablecoins as a means of savings or as a medium of exchange that enables regular value transfers free from price fluctuations drawn in by this stability.

Central Bank Digital Currencies

Regional Bank A type of cryptocurrency issued by the central banks of different nations is called digital currency. CBDCs are issued by central banks in the form of tokens or electronic records linked to the currency and pegged to the national currency of the region or nation issuing the CBDC.

Since central banks are the ones that issue this digital money, they retain complete control and regulation over the CBDC. For many nations, the adoption of a CBDC into the financial system and monetary policy is still in its early stages; however, it might spread over time.

Crypto Coin vs. Tokens: Major Difference

Many individuals have been drawn in by the astounding growth of the cryptocurrency market over the past two years, including investors and onlookers. Others took a more methodical approach by reading and comprehending the industry, while some saw a potential opportunity to make money rather quickly. Because it is a new industry, many new names are used to describe digital assets, and these terms are frequently used interchangeably.

For instance, many people think tokens and crypto coins are the same thing. Nevertheless, they are not. On a fundamental level, all coins are tokens, but not all tokens are crypto coins. So what is that? Let’s go through the major differences between coins and tokens.

- A coin is typically a blockchain native unit of exchange and value storage. A token is somewhat comparable. However, it frequently uses the blockchain of another coin. Take blockchain Ethereum as an illustration.

- Coins alone serve as a suggested medium of transaction. On the other side, tokens stand in for an asset. Tokens can be traded and staked to generate interest or held for value.

- A token is transferred from one location to another when it is used. For instance, because NFTs (no-fungible tokens) are unique products, the ownership change needs to be handled manually. It’s not necessary to move a coin from one location to another. Blockchains contain a record of every transaction.

- Simply defined, a coin indicates what a person is able to own, whereas a token indicates what they now hold. Additionally, even if not in this form, everyone has used a token at least once in their life.

Say, for example, a token is something like the title of your car. The value of the title is transferred to the new owner when you sell the vehicle. But you can’t get anything else with that name.

Launching a Cryptocurrency: What All is Needed?

How can crypto be introduced? Depending on what you’re attempting to do, the solution may shock you with how straightforward it might be. Although many different kinds of cryptocurrencies have been developed over time, some of the more well-known ones are Bitcoin, Dogecoin, and Ethereum. Digital currencies and tokens that are distinct from one another make up crypto.

Before we go through cryptocurrency’s launching process, we first need to understand the meaning of ICO because it is the term used in the launching process.

What is an ICO?

Initial Coin Offerings, or ICOs, are like IPOs on steroids. Investors do, however, receive digital tokens rather than shares in a corporation. As a result, ICOs are also frequently referred to as token offers, token crowdfunding, etc. Anyone who owns bitcoins or ether can purchase crypto-tokens during the ICO. These token generation and distribution events take place on blockchains.

Go through the following steps to help you launch your own cryptocurrency easily. Or you can also hire ICO developers to fasten your work and get the right away.

Your Idea Should Be Unique

While it may seem fairly obvious that you need an idea to launch an ICO, this is an opportunity to get feedback on your ideas from other people. You can also determine the specifics of your coin’s operation and broad objective. For instance, some coins concentrate on certain niche markets, developing blockchain solutions in front of Web 3.0, while others only want to be a coin for others to trade and invest in.

Think about whether a blockchain is necessary for the solution. Then, work out the use case’s fine points.

Draft a Whitepape

An ICO’s whitepaper serves as a road map. The proposal is laid out in the document for potential backers. The secret to defining how you plan to solve a problem is research. A reader should be provided with insights into the existing situation that enable him to identify a problem and a step-by-step remedy in the white paper. A whitepaper ought to respond to the following questions:

- What is the issue that blockchain can help you with?

- What makes sense in this situation?

- Which market would your offering target?

- What will your business plan look like?

- What marketing plan do you have?

Work on Legal Side and Learn If Crypto is Legal in Your Country

The most regulated part of crypto at the moment is ICOs. This is a result of a large number of ICOs that have shut down, disappeared with the money raised, or have simply been revealed as scams.

Initial Coin Offerings are nevertheless legal, regulated, or vulnerable to future regulation in the majority of nations. For example, only China and South Korea have formally outlawed ICOs in their respective countries to this point.

The bottom lesson is that you must become familiar with the present crypto legislation and closely monitor any upcoming changes. Don’t breach the law—this obviously goes without saying—but nevertheless. Hiring a lawyer with knowledge of cryptocurrencies and ICO legislation might be a good idea.

Create a Token

This could be the step in the ICO process that is the easiest. Fundamentally, creating a token entails producing a resource that your company requires to function. Any traded good can be represented by a token, including virtual currency, reward points, gold certificates, IOUs, in-game goodies, etc. Tokens are comparable to a firm’s shares that are sold to investors during an IPO.

Spread Words About Your Tokens

This is most likely the process’ second-most crucial stage. Your token sale won’t succeed until enough investors are aware of it. It is a sad but true fact that initial enthusiasm drives the majority of token sales. In theory, a genuine investor community that supports you and your coin and won’t sell at the first chance should support this buzz. It would be great to put time and money into the ICO marketing channels.

How Much Does Cryptocurrency Development Cost?

Regarding cryptocurrencies, the market expands every second, and correspondingly, the prices for establishing a crypto. However, app development trends and expenses fluctuate every year. Compared to previous trading models up to this point, the segment is growing three times as quickly.

The price is influenced by the components used to make the product, just like any other product development form. The cost increases with process complexity.

While assuming the cost of blockchain-based applications, it is essential to consider certain important factors such as:

- Evolving the application with a particular in-house development team

- Additionally, hiring developers for the expansion and maintenance of the crypto-based product

- Consulting blockchain app development company to check on the application’s progress and future trends

A new coin typically costs between $15k and $35k to develop. As we already indicated, the cost of generating your own cryptocurrency depends on your goals and budget. As you create your cryptocurrency token or coin, you’ll see that the customizations and functional features you choose will determine how much you spend. In general, the price is comparable to the characteristics you desire.

The Future of Cryptocurrencies

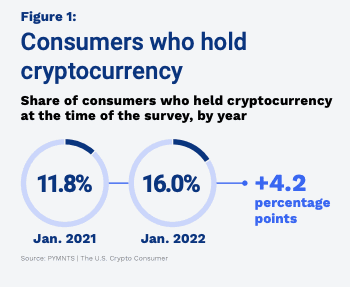

In 2022 and beyond, cryptocurrencies’ future is rather unknown. During the epidemic, cryptocurrency usage rose by unbelievable margins, and in 2021, the market saw enormous levels of trade activity. As a result, the institutional use of cryptocurrencies is prioritized, along with regulation and approval for crypto ETFs in the cryptocurrency future predictions for 2023.

All of these elements would impact the overall cryptocurrency market and how individuals and businesses interact with it. As a result, crypto can potentially displace many traditional financial products in the long run. It can, however, also be used in conjunction with currently available financial services and products, such as conventional brokerage accounts.

If you are looking to hire cryptocurrency developers for your business, Elluminati has a highly potential set of resources who can perfectly merge your business requirement into crypto solutions.